Forex Swap Trading

Contents:

It has been used as a benchmark for other international borrowers. During the https://forexhero.info/ crisis in 2008, the Federal Reserve allowed several developing countries that faced liquidity problems the option of a currency swap for borrowing purposes. They can also be used to hedge the value of an existing investment against the risk of exchange rate fluctuations. E-mail The MT4/MT5 ID and email address provided do not correspond to an XM real trading account. XM sets high standards to its services because quality is just as decisive for us as for our clients.

How Countries Should Respond to the Strong Dollar – International Monetary Fund

How Countries Should Respond to the Strong Dollar.

Posted: Fri, 14 Oct 2022 07:00:00 GMT [source]

The most common use of foreign exchange swaps is for institutions to fund their foreign exchange balances. A liability swap is a financial derivative in which two parties exchange debt-related interest rates, usually a fixed rate for a floating rate. The first foreign currency swap is purported to have taken place in 1981 between the World Bank and IBM Corporation.

How to start trading?

I have a guaranteed https://forexdelta.net/ rate crediting my account every day. The story is a little more complicated here, as the interest rates that are used are not the rates charged by the relevant central banks, but the market’s implied interest rates. These are known as tom/next rates, which determine the respective interest rates used in the Forex swap calculation. CFD and forex trading involves various currencies and interest rates.

It permits companies that have funds in different currencies to manage them efficiently. A rollover fee, also known as “swap”, is charged when you keep a position open overnight. A forex swap is the interest rate differential between the two currencies of the pair you are trading. A lot references the smallest available trade size that you can place when trading currency pairs in the foreign exchange market.

Research & market reviews Get trading insights from our analytical reports and premium market reviews. FAQ Get answers to popular questions about the platform and trading conditions. Do you want to learn how to trade with the days to cover indicator? Find out everything you need to know about the ways to calculate, uses, definitions, etc. Learn what is margin trading, buying on margin and how to use this tool correctly.

Foreign exchange swap

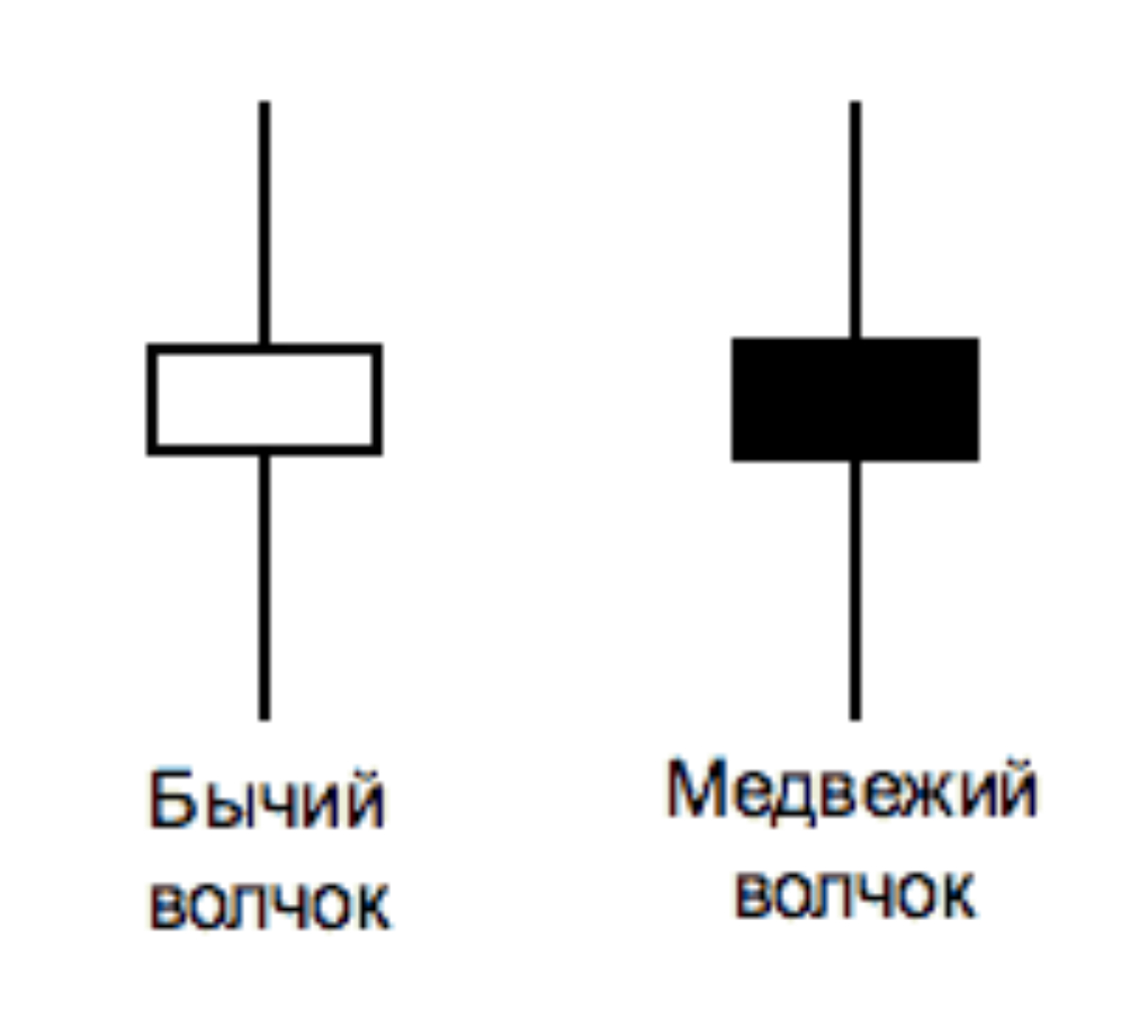

Above, I gave you the formula to calculate the base swap rate. The main parameters of this formula are basically unchanged during the year. A negative swap is when you pay it or a positive when it is paid to you. Everyone trading on the exchange must know and understand what a swap is.

UK https://traderoom.info/s may be willing to offer company A loans at 12%, while US banks can only offer company B loans at 13%. However, both companies could have competitive advantages on their domestic turfs where they could obtain loans at 8%. If both companies are seeking similar amounts in loans, company A would borrow from its US bank, while company B would borrow from its UK bank. Company A and B would then swap their loans and pay each other’s interest obligations. All traders should be aware of swap rates on the instruments they are trading, especially traders who hold open positions beyond the end of the trading day.

What is a Swap in Forex and How to Calculate

This calculator is a must for long term traders and for traders who use carry trade strategies. It does the math for you, so that you can fully focus on your trading. Swap fees will have more impact on the balance of the trading account because the fees will accumulate daily. Long-term traders handling high-volume orders, it might be of interest to avoid forex swaps by either trading with a swap-free Forex trading account or trading directly without leverage.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Adam Lemon began his role at DailyForex in 2013 when he was brought in as an in-house Chief Analyst. Adam trades Forex, stocks and other instruments in his own account.

Triple interest is earned/paid on Wednesday-Thursday rollover for Wednesday, Saturday, Sunday. WikiFX Internet and its mobile products are an enterprise information searching tool for global users. When using WikiFX products, users should consciously abide by the relevant laws and regulations of the country and region where they are located.

There are no swap charges for intraday trades that do not go over the swap time (unless the broker charges swap rates on a minute-by-minute basis, which is rare). If you hold a short position overnight using a CFD on a stock, index, cryptocurrency or commodity, you’re, in effect, lending capital to your broker. When your broker sells the underlying asset, they receive cash which earns interest until the position is closed.

- Authorised and regulated by the National Bank of Slovakia and Emerchantpay Ltd. which is authorised and regulated by the Financial Services Authority of the United Kingdom.

- You can easily see if a forex broker is legit with the help of WikiFX, a global regulatory inquiry platform.

- The Structured Query Language comprises several different data types that allow it to store different types of information…

If the variable-rate instrument holder wants more certainty about the rate they’ll receive, they’d be happy to exchange their variable cash flows for fixed ones. 89.1% of retail investor accounts lose money when trading CFDs with this provider. The swap amount has already been calculated by the broker and is displayed in the contract specifications. You can also find the swap in the table of trading financial instruments on your broker’s website or calculate it using a special trader’s calculator on the broker’s website. In the Metatrader terminal, swap is displayed in the specifications of a trading contract.

The most popular way to profit from swap rates is the Carry Trade. You buy a currency with a high interest rate while selling a currency with a low interest rate, earning on the net interest of the difference. A foreign currency swap can involve exchanging principal, as well. Usually, though, a swap involves notional principal that’s just used to calculate interest and isn’t actually exchanged. By using our swap calculator you can calculate the interest rate differential between the two currencies of the currency pair on your open positions.

That means you earn interest on the first and pay interest on the second currency. Brokers list the Swap Buy and Swap Sell Rates on their websites or trading platform. These vary from one instrument to the next as the applicable interest rates and asset lending rates vary. This means any overnight position involves a type of interest rate or currency swap.

What is rollover?

Then, they can unfold the swap later when the hedge is no longer needed. If they suffered a loss due to fluctuating exchange rates affecting their business activity, the profit on the swap can offset that. Therefore, it can behoove them to hedge those risks by essentially taking opposite and simultaneous positions in the currency. Company A and Swiss Company B can take a position in each other’s currencies via a currency swap for hedging purposes. If a currency swap deal involves the exchange of principal, that principal will be exchanged again at the maturity of the agreement. The exchange between them is based on a $1.2 spot rate, indexed to LIBOR.

Swap rates are tripled on Wednesday at 4.59pm to account for weekends. Please note that this is the standard structure of swaps – however, on weeks where there are holidays, the swap rate structure may be modified to account for the holiday. Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investment objectives and level of experience before trading, and if necessary, seek independent advice.